Monetary Instant Should Be Positive

Detailed tagging information is intended for use only by existing self-service clients.

Error Type

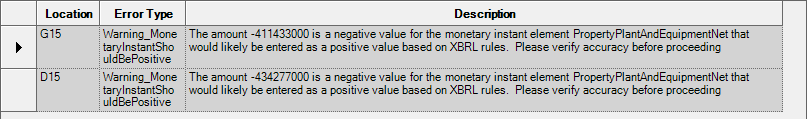

Warning_MonetaryInstantShouldBePositive

Error

The monetary amount is a negative value in the instance document.

"The amount ... is a negative value for the monetary instant elementThe representation of a financial reporting concept, including: line items in the face of the financial statements, important narrative disclosures, and rows and columns in tables. ... that would likely be entered as a positive value based on XBRLExtensible Business Reporting Language (XBRL) is an XML-based standard for defining and exchanging business and financial performance information. rules. Please verify accuracy before proceeding."

Problem

Monetary, instant elements most commonly have positive values. Because of this, any that are negative are flagged for review. Review each warning carefully based on what is appropriate for the selected element and fact.

Solution

One-way concepts require only positive numbers; review whether a two-way concept element should be used instead. Two way concept elements allow for positive and negative numbers in the instance document eliminating this error. If the value should be positive reverse and negate the number.

Example 1

Cash and Cash Equivalents, at Carrying Value

- It is extremely rare for a company to have a negative cash balance so the software will flag negative numbers being tagged with this element.

Example 2 - Shares Item Type - All Should Be positive, No Exception

Share-based Compensation Arrangement by Share-based Payment Award, Non-Option Equity Instruments, Outstanding, Number

- All shares disclosed should be positive in the instance document

Share-based Compensation Arrangement by Share-based Payment Award, Non-Option Equity Instruments, Exercised

- Even the number of shares exercised should be positive. The element is modeled so you do not need to make the number negative to show the shares being removed from your outstanding shares balance.

Copyright © 2021 Certent